#jolt hitting the ground running #gourmet #donut #coffee #carbondale

from Instagram http://instagram.com/p/hi_51ZhzU9/

Things I am enjoying

Having two dogs, both pretty much puppies, has been challenging but also a lot of fun. Besides all the love and laughter they bring, they also provide me the opportunity to walk more. The multiple exercise sessions a day along with two young kids has forced me (in a good way) to get more efficient with my work and life. As a result, I have been listening to a lot of podcasts and playing with some cool software.

I am loving the following and thought they are worth sharing:

Having two dogs, both pretty much puppies, has been challenging but also a lot of fun. Besides all the love and laughter they bring, they also provide me the opportunity to walk more. The multiple exercise sessions a day along with two young kids has forced me (in a good way) to get more efficient with my work and life. As a result, I have been listening to a lot of podcasts and playing with some cool software.

I am loving the following and thought they are worth sharing:

Hittal: Killer Keyword Suggestions (link)

HitTail tells you, in real-time, the most promising search terms you should target based on your existing traffic. We do this using a sophisticated algorithm tuned by analyzing over 1.2 billion keywords.

HitTail analyzes your visitor stream in real-time and provides you with a simple, actionable list of precisely which keywords you should be targeting to dramatically grow your organic search traffic.

Trello (link)

Whether you're planning a surprise birthday party for your best friend, writing an epic screenplay, tracking million-dollar sales leads, or just making a list of stuff to get done this weekend, Trello makes sure you're organized and on top of it all. Like a whiteboard with super powers, Trello is simple to use and infinitely flexible. You'll know exactly what needs to get done, who's going to do it, and what's coming up next. And, everything you do is synced and saved instantly to Trello.com. Use the web site to stay organized while you're at your desk, and the app to stay up to date while you're out and about.

Contactually (link)

an assistant that helps you automatically prioritize and stay in touch with your most important contacts, including potential business leads, colleagues, and friends. Regularly reconnecting with your network can improve your relationships and create opportunities in the future. It pulls in all of your email, social, and CRM contacts, so it always knows who you're talking to.

Bootstrapped With Kids Podcast (link)

Two dudes with kids talking about software, marketing, making money and other Sh!t.

Bigger Pockets Podcast (link)

Real Estate Investing & Wealth Building without the hype.

Start-ups for the Rest of Us (link)

Mike Taber and Rob Walling come together to share their insights and experience from the perspective of developers who built their respective companies without Angel or Venture Capital funding. Together, they share the things they've learned and are still learning as independent developers.

What are you enjoying?

Agreed: "Net Lease Market Remains White Hot"

Cap rates for the single tenant net leased market remained near historic lows for retail, office and industrial sectors in the first quarter of 2013. Cap rates for net lease office and industrial properties declined while retail cap rates remained at 2012 fourth quarter levels.

via Net Lease Market Remains White Hot | Commentary content from National Real Estate Investor.

HELP! Millionaire client needs money to pay hotel bill

Below is an e-mail received by me and several others from a client of mine. Note that my client is a very high net worth real estate investor.

I thought it was worth reposting as I laugh everytime I read it. Obviously, his yahoo account had been hacked.

Below is an e-mail received by me and several others from a client of mine. Note that my client is a very high net worth real estate investor.

I thought it was worth reposting as I laugh everytime I read it. Obviously, his yahoo account had been hacked.

How are you doing? This has had to come in a hurry and it has left me in a devastating state. I,Terry, and Joey had a trip down to Spain unannounced some days back for an important program, unfortunately we got mugged at the park of the hotel where we stayed,all cash, cell phones and credit cards were stolen from us but luckily we still have our passports with us.

We been to the Embassy and the Police here but they're not helping issues at all and our flight leaves tomorrow but we am having problems settling the hotel bills and the hotel manager won't let us leave until we settle the bills. Please we really need your financial assistance..Please, Let me know if you can help us out?

I'm looking forward to hearing from you.

I guess people fall for these and the Nigerian Money Scams, otherwise they would not go through the time and effort.

An, no, my client nor the recipients fell for it.

What? That's the lease price?

$2,630 psf That's the sale price per foot right?

Nope.

That's the lease price.

And I thought Walgreens paid a lot per foot for their NNN leases.

Based on below, how much would the building be worth if I rented a 1,000 sf building in Hong Kong Causeway Bay to Prada for the going rate of $2,630 psf? Let's assume NNN rent and going cap rate for such a primo location is 4% (which might be high!)

Based on below, how much would the building be worth if I rented a 1,000 sf building in Hong Kong Causeway Bay to Prada for the going rate of $2,630 psf? Let's assume NNN rent and going cap rate for such a primo location is 4% (which might be high!)

Annual rent: $2,630,000

Value at 4 cap: $65,750,000 for my 1,000 sf space

So... $65,750 psf to buy the space.

Makes Walgreens $300 to $400 psf look like a steal! Or Aspen at $1,000 psf is also a steal.

The Dangerous Allure of Distressed Real Estate

But that's why the yield is higher! Love the napkin sketch........

Buy Opportunistic Real Estate and Value Added Real Estate (links)

via The Dangerous Allure of Distressed Real Estate - NYTimes.com.

The six best books for Commercial Real Estate Brokers

I get emails all the time from people looking to get into the commercial real estate brokerage business. They ask:

- How do I go from residential to commercial real estate?

- How do I get commercial real estate clients?

- How do I market and sell commercial property?

- How much money can I make in commercial real estate?

I give them as many tips as I can after 10+ years in the business and almost $200M in volume but experience and time are the best teachers. There are also several good books on the commercial real estate business.

Here are my top six commercial real estate broker books:

If that is not good enough, here are some recommendations on:

Real Estate Investment Books and Real Estate Development Books

Also check out: How to succeed in Commercial Real Estate

IMMEDIATE NNN BUYER NEEDS

We represent clients looking for matching NNN properties: Buyer #1: Walgreens with 15 or more years firm term. Anywhere in US. Price and cap rate dependent on location and term up to $8M.

Buyer #2: Tractor Supply, anywhere in US, price and cap rate dependent on location, term and lease type. Former absolute net leases preferred but would look at brand new NN leases.

Buyer #3: Bite size ($300k to $500k) NNN deal anywhere in US with credit tenant, 5 years minimum on term, 7% cap or higher.

Off-market deals preferred. Have seen everything on Loopnet. No daisy-chains please.

Call or email Thomas Morgan, CCIM with matching NNN properties. 1-866-539-1777

NNN Properties and Your Future

NNN properties are a popular avenue for commercial real estate investment. These are typically single-tenant retail properties where the tenant is responsible for paying real estate taxes, providing their own property insurance and taking care of all property maintenance. Tenants take care of these expenses in addition to other monthly costs such as rent and utility payments. Part-time investors can find NNN properties to be an appealing real estate investment option. It offers a guaranteed stream of income from a real estate investment while also absolving the investor of carrying out many day-to-day management responsibilities for the property.

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can enjoy tax benefits that come from investing in commercial or residential real estate. Finally, successful NNN properties can act as a gateway for securing additional financing to use on other investments.

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can enjoy tax benefits that come from investing in commercial or residential real estate. Finally, successful NNN properties can act as a gateway for securing additional financing to use on other investments.

There are risks in leasing out triple net properties to the wrong tenant. An investor needs to know how to identify a good tenant versus a bad tenant. Assessing the worthiness of any tenant requires an investor to examine a company's business model and the state of its finances. Signing up a tenant in haste can result in disaster for any investor.

A company's credit rating offers an indicator of risk for default. While no investments outside of a federal bond offer a zero percent default rate, a tenant possessing an investment grade credit rating presents less of a risk for NNN properties.

Leasing NNN properties to a company essentially provides them capital. An investor needs to know if their tenant can guarantee long-term success with that capital. Investors should examine multiple criteria when choosing tenants for their triple net properties. They should examine a company's debt to equity ratio, operating margins, the number of stores it operates, the outlook for that industry and how the company is managed.

Investors in NNN properties should also take into account other factors. A successful investment can hinge on everything from location and building size to economic conditions for a particular industry. Triple net properties work best for a smart investor who buys in the right location and selects a low-risk tenant.

Investors in NNN properties should also take into account other factors. A successful investment can hinge on everything from location and building size to economic conditions for a particular industry. Triple net properties work best for a smart investor who buys in the right location and selects a low-risk tenant.

Knowing local market conditions is essential for any serious investor. It is important to pay attention to everything from the employment rate to median income in a community before selecting a property. A bad investment can leave an investor with an empty building that is essentially a money pit.

In the end, NNN properties are a great passive income investment that produce low risk yields of 7% or more with little investor oversight and involvement. Contact Thomas to find out more about NNN properties or to buy/sell a NNN property: 1-866-539-1777 or e-mail.

TMO sells $12M Walgreens Property

In mid August, TMO represented the buyer of a northern California NNN Walgreens property. The property sold for $12,184,846 and is leased on an absolute triple net basis to Walgreens (Ticker: WAG) on a 75 year lease with 24 firm years remaining. The buyer was a privately held real estate investment company from New York who was in a 1031 Exchange. The seller was represented by Capital Pacific's San Francisco office. The low leverage transaction was financed by Lafayette Life Insurance Company which was placed by Ed Isola from Isola & Associates.

For further details about the cap rate and financing terms, please contact Thomas Morgan, CCIM via email or toll free at 1-866-539-1777.

1.866.539.1777

Walgreens NNN Deal Round Up

Here is this week's round up of Walgreens NNN properties for sale across the the US. These Walgreens properties caught my eye as part of research for Walgreens buyers I am working with. Contact TMO for for details of these net leased Walgreens via email or 1-866-539-1777

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location. Learn more...

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location. Learn more...

Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Learn more...

Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Learn more...

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A) Learn more...

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A) Learn more...

Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location. Learn more...

Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location. Learn more...

Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store. Learn more...

Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store. Learn more...

Contact TMO for for details of these net leased Walgreens via email or 1-866-539-1777

Deals are a sampling of available Walgreen NNN inventory from around the US and are for reference only. Subject photos may not be actual location and are representative of Walgreen locations in general.

JUST CLOSED: TMO has $3M+ week

It was a good week at TMO Inc! TMO sold two investment properties to two separate real estate investors:

$2,455,000 net leased TSC in Arkansas

It was a good week at TMO Inc! TMO sold two investment properties to two separate real estate investors:

$2,455,000 net leased TSC in Arkansas

and

$655,000 single family investment house in Willits/El Jebel, Colorado

Both investors purchased for the low risk cashflows and passive income that investment real estate provides. For more information on these sales or to set-up a free no obligation real estate investment consultation with TMO please email or call 1.866.539.1777

Or visit these helpful pages:

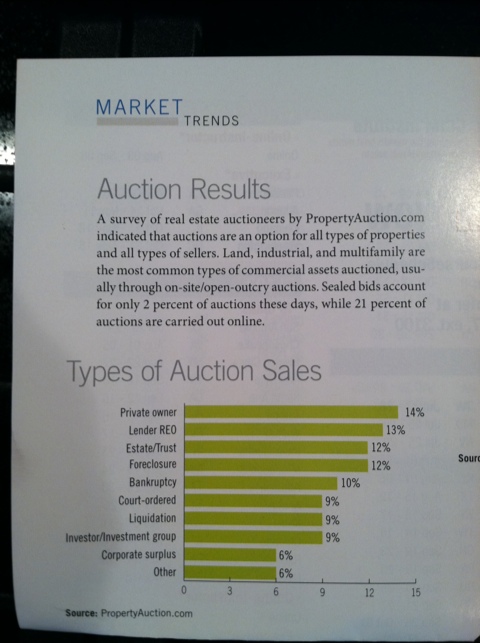

Who auctions real estate?

Most auctions are bank owned and foreclosures right? Wrong... I learned from and interesting set of stats from CIRE magazine. 21% of real estate auctions are now carried out online and the largest type of real estate auction is from private investors.

TMO sells $2.24M net leased Tractor Supply

TMO is pleased to have represented a private investor in the purchase of a NNN leased Tractor Supply property in Sweetwater, TX. The all cash transaction closed in under 30 days for $2,242,500 at a cap rate of 8%.

TMO is pleased to have represented a private investor in the purchase of a NNN leased Tractor Supply property in Sweetwater, TX. The all cash transaction closed in under 30 days for $2,242,500 at a cap rate of 8%.

Buy a Tractor Supply NNN Property

"Tractor Supply (TSCO) is a great reliable tenant with a solid business model which provides my client with peace of mind for years to come." says Thomas Morgan, CCIM. "TSC's may be in smaller markets but that is where their customers are and they serve the rural farming towns perfectly. Compared to a NNN Walgreens or fast food NNN investment, TSC's have a lot of residual value in the real estate as they are on large lots, usually 4-5 acres and have decent size buildings of around 20,000 sf built of block."

Lior Regenstreif of Marcus Millichap represented the Seller.

You can trust me, I'm a Doctor

When someone tells you "trust me" do you believe them or is it time to run for the hills?

Brokers I deal with and sometimes clients often pull me aside and whisper in my ear "you can trust me" or "I am the most trustworthy person you'll meet". I am not sure about you but my red flag radar immediately goes off. If I really could trust you, you probably would not have to tell me that I can trust you, your character would speak for yourself.

When someone tells you "trust me" do you believe them or is it time to run for the hills?

Brokers I deal with and sometimes clients often pull me aside and whisper in my ear "you can trust me" or "I am the most trustworthy person you'll meet". I am not sure about you but my red flag radar immediately goes off. If I really could trust you, you probably would not have to tell me that I can trust you, your character would speak for yourself.

"People will forget what you said, people will forget what you did, but they will never forget how you made them feel." -Maya Angelou via

Marvin says "beware". Joe Sutton tries to untangle the web of trust and promises. Tamar Frankel, an authority on securities law, is a professor at Boston University School of Law and author of “Trust and Honesty: America’s Business Culture at a Crossroad.” ponders whether or not securities brokers should be prohibited from having conflicts of interest when they give advice, and, if they do have a conflict, to tell their clients clearly what those conflicts are.

So... what am I trying to tell you... "trust me" ... oh wait.... I'll keep my mouth shut and let my character do the talking.

If we can't take ourselves lightly, who will?  Frank Sarwark titled his blog "Trust Me, I'm a used car salesman" and he is, seriously, a used car salesman.

Frank Sarwark titled his blog "Trust Me, I'm a used car salesman" and he is, seriously, a used car salesman.

At the end of the day, Mehmet Akyuz says it best, "Trust me, I know what I'm selling" and if we all know who is being sold to and who is doing the selling, then maybe we can all relax a little.

What is Triple Net NNN? Triple net lease definition

What is a Triple Net Lease? Here is a quick summary of the triple net lease definition: A lease in which the lessee (tenant) pays rent to the lessor (landlord), as well as all taxes,insurance, and maintenance expenses that arise from the use of the property. The base rent is "net" to the landlord and landlord does not pay any expenses for operation of the property.

What Does Triple Net Lease Mean?

A lease agreement that designates the lessee (the tenant) as being solely responsible for all of the costs relating to the asset being leased in addition to the rent fee applied under the lease. The structure of this type of lease requires the lessee to pay for net real estate taxes on the leased asset, net building insurance and net common area maintenance. The lessee has to pay the net amount of three types of costs, which how this term got its name: net, net, net or NNN or Triple Net

What Does Triple Net Lease Mean?

A lease agreement that designates the lessee (the tenant) as being solely responsible for all of the costs relating to the asset being leased in addition to the rent fee applied under the lease. The structure of this type of lease requires the lessee to pay for net real estate taxes on the leased asset, net building insurance and net common area maintenance. The lessee has to pay the net amount of three types of costs, which how this term got its name: net, net, net or NNN or Triple Net

Triple Net Lease is also be referred to as a "net-net-net lease" or a "hell or high water lease"

This is how Investopedia explains Triple Net Lease

For example, if a property owner leases out a building to a business using a triple net lease, the tenant will be responsible for paying the building's property taxes, building insurance and the cost of any maintenance or repairs the building may require during the term of the lease. Because the tenant is covering these costs (which would otherwise be the responsibility of the property owner), the rent charged in the triple net lease is generally lower than the rent charged in a standard lease agreement. This is also called the net rent or base rent.

is generally lower than the rent charged in a standard lease agreement. This is also called the net rent or base rent.

Contact TMO to find out more about the benefits of Triple Net Leased Real Estate Investments. 1.866.539.1777

Typical net leased properties and net leased investments are leased to investment grade credit tenants such as:

- Walgreens

- Best Buy

- Home Depot

- Lowes

- Wal-Mart

- McDonalds

- Burger King

- Auto Zone

- Checker Auto

- Tractor Supply Company

- and many other triple net lease tenants

CRE- The Tenant Advisor Blog

Check out my twitter "friend" Coy Davidson's blog about commercial real estate. Coy is a CRE Professional with Colliers International in Houston and specializes in Tenant Representation and Corporate Real Estate Strategy. The Tenant Advisor: assisting corporate users and businesses with their office space and facility requirements, identifying optimal, cost effective locations, structuring transactions and corporate real estate strategy that compliments their business objectives.

You can follow Coy on twitter at: @CoyDavidsonCRE

Best Real Estate Development Books

Here are TMO's reccommended Real Estate Development Books:

BUY Real Estate Development Books here

- Professional Real Estate Development, Second Edition: The ULI Guide to the Business

- Anne B. Frej (Author), Richard B. Peiser (Author)

- Real Estate Development and Investment: A Comprehensive Approach S. P. Peca (Author)

- The Complete Guide to Financing Real Estate Developments Ira Nachem (Author)

- The Real Estate Developer's Handbook: How to Set Up, Operate, and Manage a Financially Successful Real Estate Development Tanya Davis (Author)

BUY Real Estate Development Books here

See all Real estate development books

Brownfield Redevelopment Books

As you know TMO is involved in Brownfield Redevelopment nationwide.

Here is a list of books which I think are the best for Brownfield Redevelopment: (You can review and buy them here: Brownfield Redevelopment

-Brownfields Redevelopment and the Quest for Sustainability, Volume 3 (Current Research in Urban and Regional Studies) [Hardcover] Christopher A. De Sousa

-Brownfields III: Prevention, Assessment, Rehabilitation And Development of Brownfield Sites [Hardcover]

C. A. Brebbia and U. Mander

-Strategies for Resolving Environmental Land Use Disputes: Leading Lawyers on Responding to Changing Environmental Protection Standards, Ensuring Compliance ... Brownfield Redevelopment (Inside the Minds) [Paperback] Aspatore Books Staff

-Greening Brownfields: Remediation Through Sustainable Development [Hardcover] William Sarni

-Brownfields Redevelopment: Programs and Strategies for Contaminated Real Estate by Mark S. Dennison

You can review and buy them here: Brownfield Redevelopment

How can this historic building best be used?

How can this historic building best be used? For the community? For the users? For the owners?

Winning Idea will get $100 Amazon Gift Certificate!!

How can this historic building best be used? For the community? For the users? For the owners?

Winning Idea will get $100 Amazon Gift Certificate!!

Contest Here: montrosemasonic.crowdcampaign.com

Former Masonic Temple Building, Montrose CO

509, 511, 513 East Main Street, Montrose CO

We invite local residents, business leaders and government officials to share ideas and vote! Even if you live 3,000 miles away, we want to hear you ideas also.

Here are some details of the building, it is currently for lease and for sale: