Guest Post by Will Schnier, P.E., President of BIG RED DOG Engineering | Consulting

There are many reasons why somebody purchasing property would want to obtain the necessary survey products. For this discussion, at a minimum, I recommend that you should always obtain a current title survey, based on a title commitment less than 30-days old. A title survey will include information regarding property lines, location of improvements, easements, utilities and other conditions affecting the property.

There are many reasons why somebody purchasing property would want to obtain the necessary survey products. For this discussion, at a minimum, I recommend that you should always obtain a current title survey, based on a title commitment less than 30-days old. A title survey will include information regarding property lines, location of improvements, easements, utilities and other conditions affecting the property.

I would also suggest that you consider obtaining a full tree, topography, and boundary survey in addition to the title survey if it’s appropriate for your purchase and project/investment intentions. The tree, topography, and boundary survey is also referred to as a design survey, and may be used by an engineer or architect to develop site development and building plans.

My top five reasons for you to obtain a survey are as follows:

1.) Know what you’re buying – the survey will identify the exact limits of the property boundary and improvements on the property.

Real estate can have title and boundary disputes (unfortunately it’s more common than you’d expect), which a title survey would help to uncover. Furthermore, relying upon tax district information on the lot or building size, or seller furnished documentation can be a recipe for expensive trouble without proper due diligence.

2.) Discover the presence and exact location of any easements, restrictions, or other encumbrances that may be imposed upon the property.

You may look out on a piece of property and see a green field, or a paved parking lot, and simply assume that that land is available for you to develop easily. How does that change if there are drainage or utility easements in that location? You may still be able to develop, yes, but your cost just went up a lot more than the cost of the survey.

Or suppose, you’re out in the county, not under the jurisdiction of a municipality that can impose zoning and land use restrictions. So you can build what you want right? What if a former owner of the property restricted its use, in an effort to promote a certain type of community? That 10-acre tract you intended to use for your commercial construction business may not be feasible if there is a deed restriction from 30 years ago limiting the use of the property to residential.

3.) If you’re spending significant money, it makes sense to an additional thousand or few thousand on a title and design survey.

Obtaining a title survey is an affordable way to obtain some more peace of mind with the transaction. Don’t be penny-wise and pound-foolish. You should do everything you can to protect the investment you’re making. A title survey could be as little as $1,000.

4.) The title and/or design survey can be used in the future to prepare drawings and exhibits, and to apply for building permits.

If you’re buying an office building for example, your prospective tenants may ask for a site plan showing the parking locations on the property – well now you have a survey you can supply them. Suppose again you want to apply for a minor building permit to expand the same office building - having a survey in hand will be a necessary step in that process.

5.) You can make the other guy pay!

All real estate contracts, residential or commercial, contain a clause specifically assigning the cost of the tile survey to either the buyer or the seller. Check the box next to the other guys name; this point is rarely an issue of significant contention during the negotiation process.

For more reading, I would encourage you to visit the BIG RED Blog. On you blog you will find very useful information on the land subdivision and site development permitting process, and highlights of specific BIG RED DOG projects, such as our new downtown Austin hotel at 416 Congress Avenue.

About Will Schnier, P.E.:

Will Schnier is the President of BIG RED DOG Engineering | Consulting. He has been responsible for the project management, engineering design, and regulatory permitting of numerous multifamily residential, retail, office, and industrial site development projects throughout central Texas. He can be reached by email at Will.Schnier(atsign)BIGREDOG.com or by phone at (512) 669-5560.

About BIG RED DOG Engineering | Consulting:

BIG RED DOG is an Austin, Texas-based civil engineering firm specializing in land development engineering, permitting, and land use consulting. Our team of professional civil engineers and certified land planners has over 100-years of combined experience in the Austin and central Texas market. Our commercial project experience includes multi-family, hotel, office, industrial, retail, and single-family subdivision development projects throughout central Texas.

Is your commercial property driving you crazy? Too much management? Not enough income? Do you need to sell your commercial property fast? Not sure what to do with your commercial property? Time to move on? Or... just need help

Is your commercial property driving you crazy? Too much management? Not enough income? Do you need to sell your commercial property fast? Not sure what to do with your commercial property? Time to move on? Or... just need help  nationwide. We will

nationwide. We will

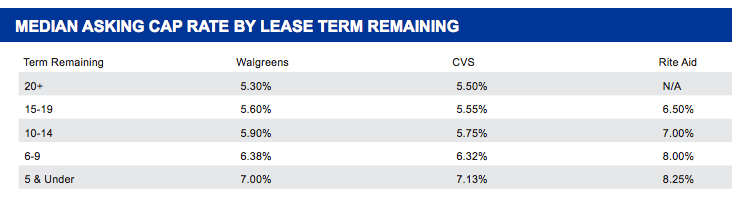

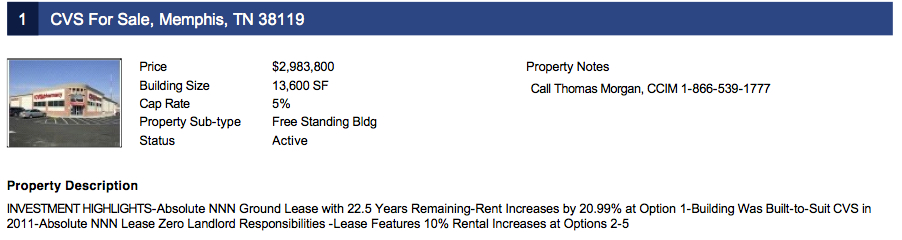

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

Ground lease investment properties are some of the most unique types of NNN opportunities.

While a regular "fee simple"

Ground lease investment properties are some of the most unique types of NNN opportunities.

While a regular "fee simple"

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location.

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location.  Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A)

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A)  Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location.

Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location.  Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store.

Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store.  When purchasing a

When purchasing a