Owning commercial investment property is a great pleasure especially when you have good solid tenants.

Marijuana pays the rent.

In Denver and California commercial retail property owners have found that "pot dispensaries" have filled vacant spaces in the down economy.

"Looking at California, the pioneer state of medical marijuana, shows how great the demand really is for medical marijuana. One study reported that Los Angeles county alone has over 800 marijuana dispensaries."

But the "high" does not last forever.

Considering pot is still illegal, it may be time to find another tenant.

What about a drug dealer that has $72 billion in revenue and a S&P rating of A?

This is not your back alley drug dealer. This drug dealer in on busiest corners. Has well lit parking lots. Incredible signage. Is open 24 hours an has 7,830 stores worldwide.

This drug dealer is Walgreens.

As a commercial property investor looking for long term passive income, you have to consider a Walgreens. Walgreens typically signs 75 year leases. Walgreens has the best locations. Walgreens leases are true triple net meaning the landlord has NO responsibilities. Absolutely none. The owner sits back and deposits the monthly rent.

Triple Net Walgreens range from $4M to $12M and easily produce a 6%+ annual yield for an all cash purchase. Non-recourse financing is easy to obtain especially at 60% or less LTV at sub 5% interest rates which can increase the overall annual yield to 8% or better.

Here are some triple net Walgreens currently for sale around the US. Contact TMO for more information on any of them or to set up a free no-obligation real estate investment consultation.

Walgreens NNN Real Estate For Sale

Walgreens NNN Real Estate

Walgreens NNN Real Estate

- PA

- $6,770,000

- Cap Rate: 6.50%

Absolute-Net Lease of 75 years. "A" Credit Rating by Standard and Poors.

Walgreens NNN Property

Walgreens NNN Property

- OK

- $4,950,000

- 6.61% cap rate

Located in the Oklahoma City MSA, Investment grade tenant, Over 22 years remain on lease, Adjacent to I-40 interchange

Walgreens Triple Net Property

Walgreens Triple Net Property

- FL

- $10,915,000

- Cap Rate 6%

Rare rent increase, absolute NNN lease, daily traffic count exceeds 44,500

Walgreens Triple Net Real Estate

Walgreens Triple Net Real Estate

75 years simple Ground lease, irreplaceable corner location

Walgreens Net Leased Property

Walgreens Net Leased Property

Established Walgreens Location Operating Since 1957. 60 Years Lease - Strong Store Sales. Less than One-Mile from Advocate Trinity Hospital.

Great NNN real estate.

Contact TMO about these NNN Walgreens. Toll free 1.866.539.1777 or e-mail.

[gravityform id="3" name="Quick Contact" description="false"]

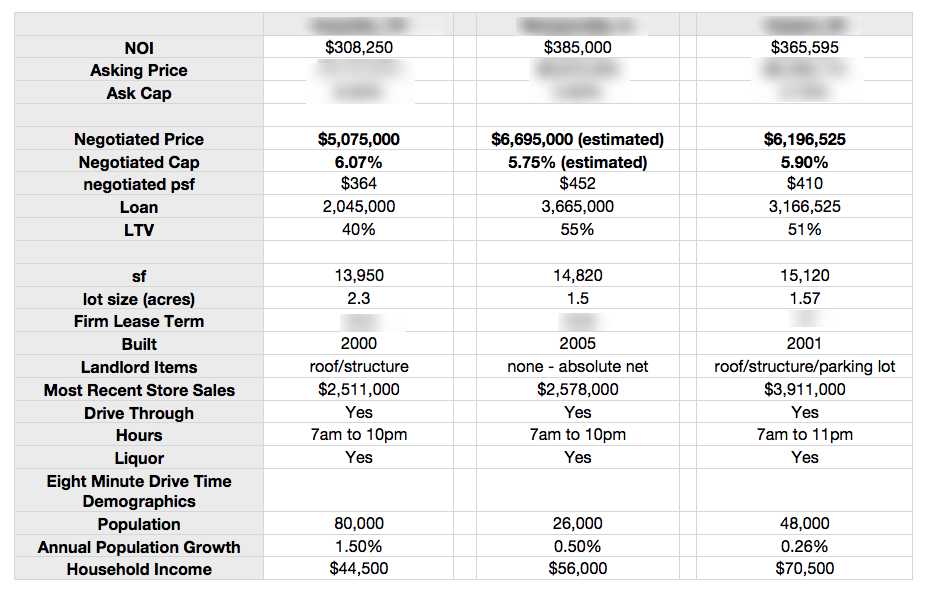

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can